Starting a food truck business can be one of the smartest investments you make — but getting financing isn’t always simple. At Factory Food Trucks, we help customers with all types of credit — good, medium, or even bad — get approved for the food truck financing they need to start serving their dream cuisine.

We understand that every customer’s financial situation is different. That’s why our process is personal, flexible, and built to help you qualify — even if you’ve been turned down before.

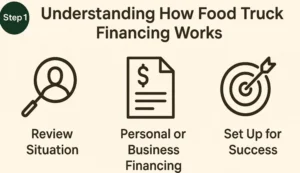

Step 1: Understanding How Food Truck Financing Works

Before we start the financing process, we review each customer’s situation carefully to find the best route: personal financing, business financing, or credit improvement and re-submission.

We don’t believe in one-size-fits-all approvals — we believe in setting you up for success.

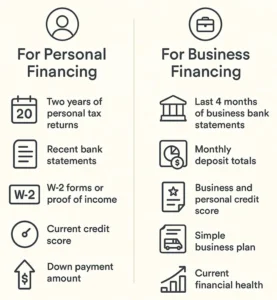

Step 2: Information We Collect Before Financing

Before we finance a food truck, we need to understand who you are financially and professionally. Our team collects key details to match you with the right lenders or brokers.

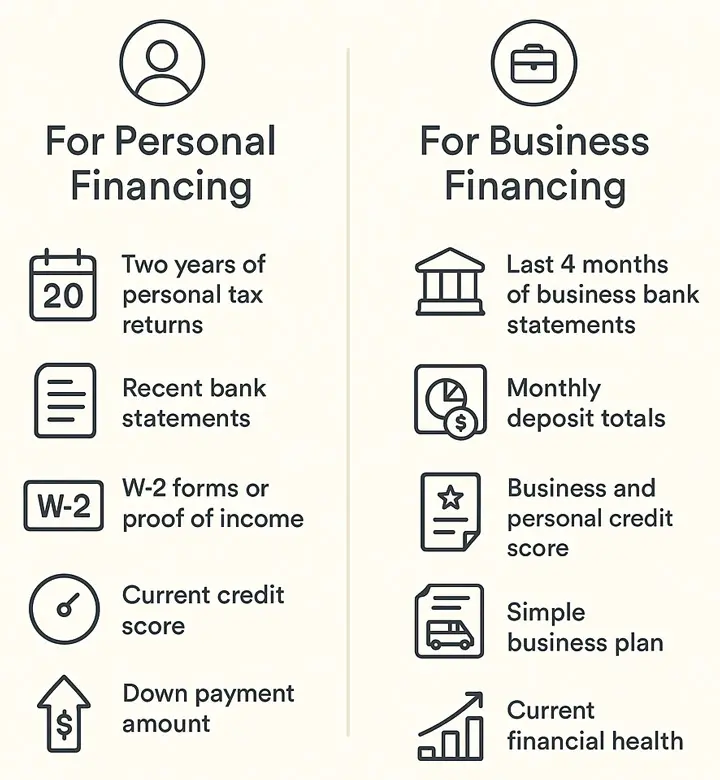

For Personal Financing (no LLC or business yet):

We’ll ask for:

- Two years of personal tax returns

- Recent bank statements

- W-2 forms or proof of income

- Current credit score

- Work experience (especially in food service or management)

- Down payment amount you can contribute

This helps us determine your repayment ability and find programs that fit your credit range — from strong credit to rebuilding credit.

For Business Financing (existing LLC or corporation):

We’ll ask for:

- The last 4 months of business bank statements

- Monthly deposit totals to assess cash flow

- Business credit score and personal credit score of the owner(s)

- A simple business plan outlining your food truck operations and goals

- Current financial health of the business

Established businesses often qualify faster, but even startups can get approved with the right structure and documentation.

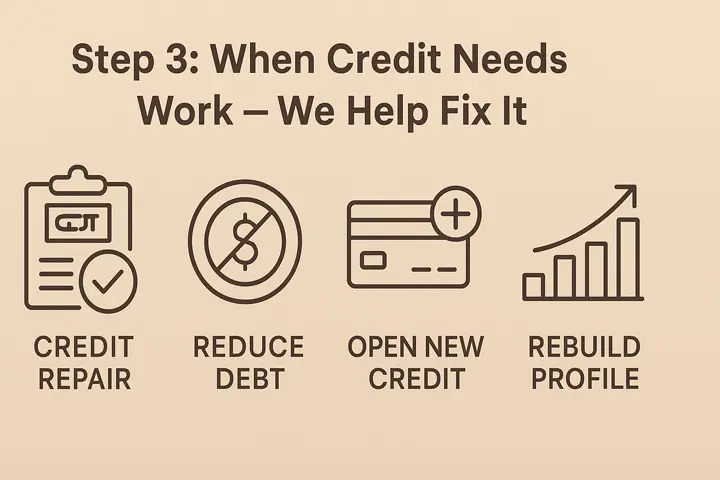

Step 3: When Credit Needs Work — We Help Fix It

If you don’t qualify right away, don’t worry — that’s where our credit repair and improvement partners come in.

We work with companies that help customers:

- Remove unnecessary or outdated hard inquiries

- Reduce credit card usage by improving debt ratios

- Open new credit lines to raise overall credit limits (without overspending)

- Build a stronger profile over time to reapply successfully

Our goal is to make sure every customer can move forward — even if it takes a few months to fix credit before financing their truck.

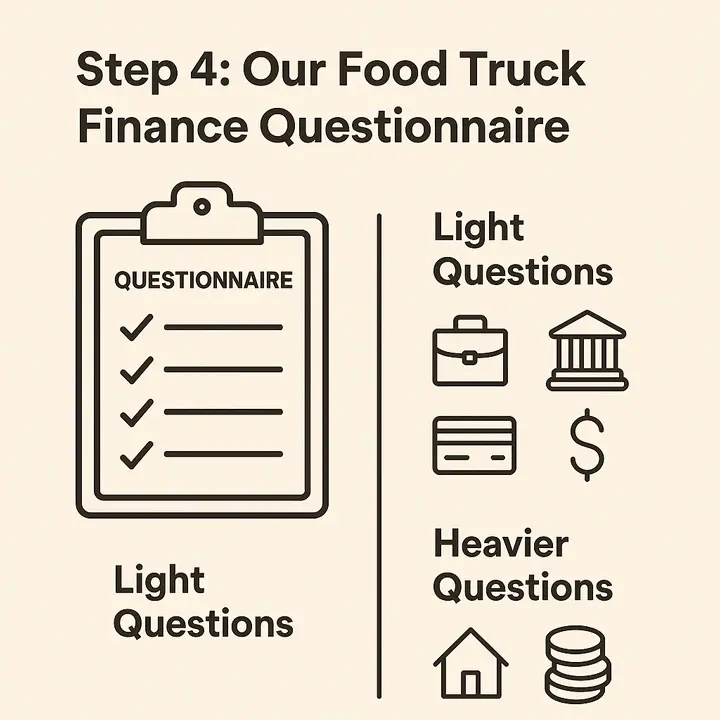

Step 4: Our Food Truck Finance Questionnaire

When you contact us for financing, we’ll guide you through a quick series of questions that help us decide whether to apply for a personal loan, business loan, or begin credit repair preparation.

Sample Questions:

Light Questions

- What is your work experience in food or business ownership?

- Have you registered an LLC or corporation for your business idea?

- What’s your approximate credit score?

- How much can you put down as a down payment?

- Do you already have a written business plan?

Heavier Questions

- How much do you have in savings or investments?

- Do you own a home or property?

These answers help us choose the right lender or broker category and determine how soon we can get you approved.

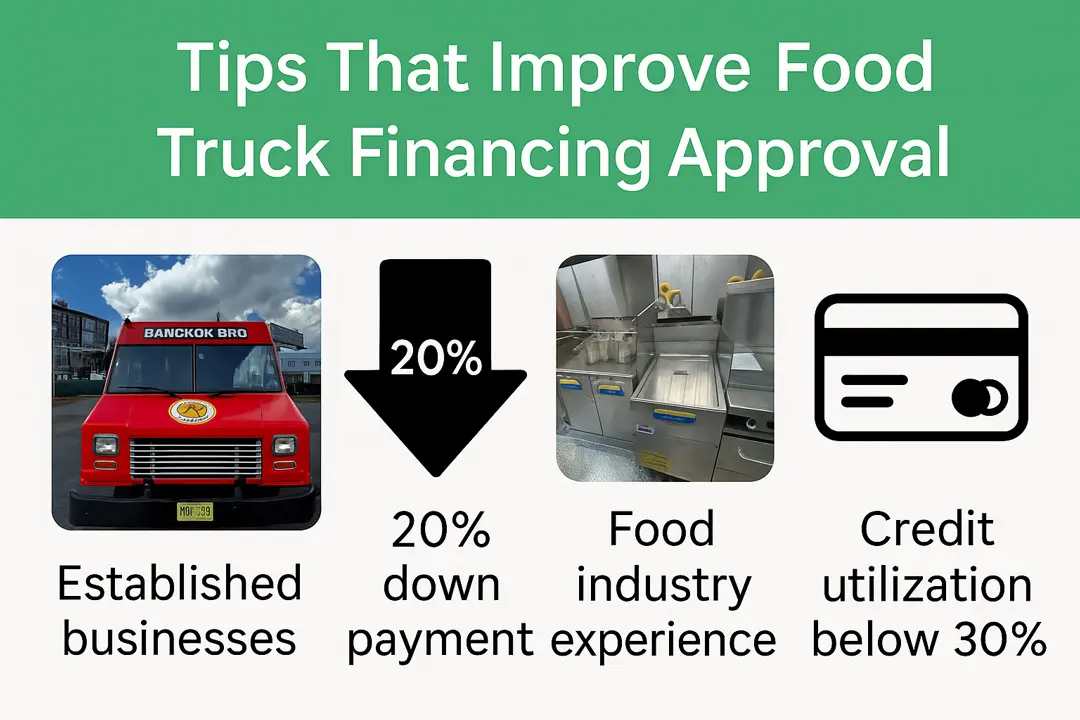

Tips That Improve Food Truck Financing Approval

- Established businesses have the highest approval rates.

- 20% down payment on the total truck cost strengthens your application.

- Food industry experience — or other business management experience — can offset weaker credit.

- Keep you credit utilization below 30% before applying.

Even if your credit isn’t perfect, we specialize in helping motivated entrepreneurs qualify through alternative programs or step-by-step improvement plans.

Why Choose Factory Food Trucks for Financing

- When you apply for financing through us, you’re not just buying a truck — you’re partnering with a team that understands how lenders think and how food trucks operate.

- We’ll walk you through every step — from documentation to approval to delivery — and connect you with the best financing brokers in the industry who specialize in commercial food trucks.

- Whether you have good credit, low credit, or no business credit yet, we’ll help you find a path that fits your situation and timeline.